Gigafactory investments are flourishing in Europe

The Age of Cathedrals has gone ? The Age of Gigafactories has come. Every month is unveiling new gigafactory investments.

The scene is really heating up in Europe . Europe has 40 new gigafactories investments planned, representing a total of around €30 billion

Electrical Vehicle market is surging

According to the latest forecasts, 40% of all new cars sold will be electric by 2030, rising to almost 100% of the new car market by 2040.

Governments and Car industry on top of new gigafactory investments

- Emmanuel Macron unveiled a €2 billion investment by Shanghai-based Envision AESC for a battery factory in Douai to power Renault Group electric vehicles.

- Boris Johnson announced a £1 billion investment by Nissan Motor Corporation + Envision in Sunderland to produce a new generation electric crossover.

- Stellantis(Chrysler, Peugeot, Fiat, Opel, Dodge…) announced an EV battery strategy of over 260GWh by 2030, supported by five “Gigafactories” between Europe and North America, a plan of 30 €Billions through 2025.This will be an addition to the 2 factories in Douvrin (Fr) and Kaiserslautern (D). Italy is in the scope for the next Gigafactory.

Tesla built the first European Gigafactory

After its first Gigafactory in the Nevada desert, Tesla has located its European Gigafactory near Berlin. A 6 billion euro investment including a 1 billion euro subsidy from the EU.

BYD and CATL , 2 new projects of Gigafactory in Hungary -Europe

BYD, which is currently the largest producer of electric vehicles in the world, surpassing even Tesla’s sales numbers with 1.86 million battery-powered cars sold in 2022, plans to build a new Gigafactory in Europe. Located in the southern Hungarian city of Szeged, this facility aims to produce 200,000 cars annually, generating thousands of local jobs. With its success in attracting investment from major players like BYD and CATL, Hungary has proved to be a favorable destination for Gigafactory projects within Europe. Speaking of CATL, the company is building a massive $7.8 billion plant as well in Hungary as it sees the high potential for European markets.

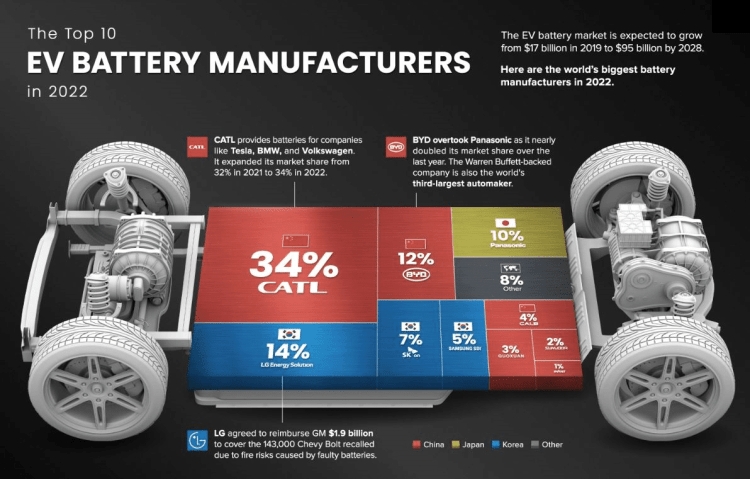

China Dominance in Battery Manufacturing

With a production capacity of nearly 900 gigawatt-hours, or 77% of the world’s total, six of the world’s top ten battery manufacturers are located in China. Behind China’s dominance in batteries is its vertical integration throughout the electric vehicle supply chain, from mining the metals to producing the electric vehicles. China is also the largest market for electric cars, accounting for 52% of global sales in 2021.

Poland is second with less than one-tenth of China’s capacity. It’s also home to LG Energy Solution’s Gigafactory in Wroclaw, the largest of its kind in Europe and one of the largest in the world. Overall, European countries (including non-EU members) accounted for only 14% of global battery production capacity in 2022.

Although the U.S. is overshadowed by China in terms of batteries, it’s also among the world’s lithium-ion powerhouses. In 2022, there were eight major battery factories there, located primarily in the Midwest and South.

Battery is the new gold:

As the desire to reduce carbon emissions from transportation has grown, the producers of EV batteries have seen a surge in demand. At present, Chinese businesses account for 56% of the EV battery industry, with Korean firms second at 26% and Japanese companies making up 10%.

Top Battery Manufacturers

The top battery supplier, CATL, increased its share from 32% in 2021 to 34% in 2022, with a third of all EV batteries sourced from this Chinese corporation. CATL supplies lithium-ion batteries to Tesla, Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo.

Most battery/EV manufacturers are from Asia, but some European Players are getting into the game.

Swedish start-up Northvolt has already secured contracts worth €27 billion, including a €14 billion order from Volkswagen AG to produce its batteries for the next decade and a €2 billion order from BMW Group.

Norwegian energy company FREYR is planning a gigafactory in Mo i Rana, powered by wind and hydro energy, and a 50 kW plant in the US.

In France, the start-up Verkor is aiming for a gigafactory in southern Europe in collaboration with Schneider Electric and InnoEnergyEU.

Environment and Batteries : Gigafactory investments in question

Batteries are made from rare earths (REE) such as lithium, nickel, cobalt or graphite, depending on mining activities. There are also a number of questions about the environmental impact and recycling implications.

Are we entering the era of a new electrical revolution ?

Leading destination for Foreign Investments

Since 2019, France is the leading destination in Europe for Foreign investments. Why do foreign company choose France. Our review of attractiveness, investments by sectors and breakdown of investing countries for your guidance.

Our experts will be pleased to advise your international development projects, do not hesitate to contact us

About Emmanuel Facovi the Founder and Managing Partner

As former CEO / senior executive (Nokia, Coface, FCI, Kompass, Schneider, Areva…) his expertise consists in leading tech companies (SaaS, marketplaces, Techs) with ambitious growth objectives in fast-changing environments.

As former CEO / senior executive (Nokia, Coface, FCI, Kompass, Schneider, Areva…) his expertise consists in leading tech companies (SaaS, marketplaces, Techs) with ambitious growth objectives in fast-changing environments.

He is a cross-cultural high technology executive passionate about new technology, innovation, disruptive models, and above all, scaling up your business globally. One of the most renowned Experts in Data, Marketing Strategies of Tech and Digital Industries,

As an« all-rounder» entrepreneur with a proven track record of building high-performing teams, he has a wide skill set ranging from Strategy and International Sales performance, also encompassing Finance, Marketing/advertising and legal/HR/culture.

He is an enthusiastic leader, keen on making sure that the office develops every day into an even “Greater Place to work”, gathering professionals of diverse talents who succeed together with a common vision in mind.

#electricvehicles #investment #automotive #tesla #batteries #gigafactories #energy